The Federal Reserve published its most recent Senior Loan Officer Opinion Survey on Bank Lending Practices as of January 2024, which covers standards, terms, and demand for loans to businesses and households from the previous quarter. Responses were recorded from 84 banks, and the aggregated data can be used to establish a baseline for what the financial industry as a whole is observing.

General Trends

The SLOOS survey covers four sections, Commercial and Industrial (C&I), Commercial Real estate, Residential Mortgages, and Consumer Lending. Across all sectors, we can observe central lending trends. At the highest level a majority of banks are reporting tighter lending standards and less willingness to make loans than average, but these trends are coming off of their peaks. In other words, some folks are starting to loosen their underwriting, but most are not. Similarly, in each sector, loan demand remains below the historical average but is starting to improve somewhat. The one exception to that trend is residential mortgage lending, which remains abysmally low.

Loan Demand

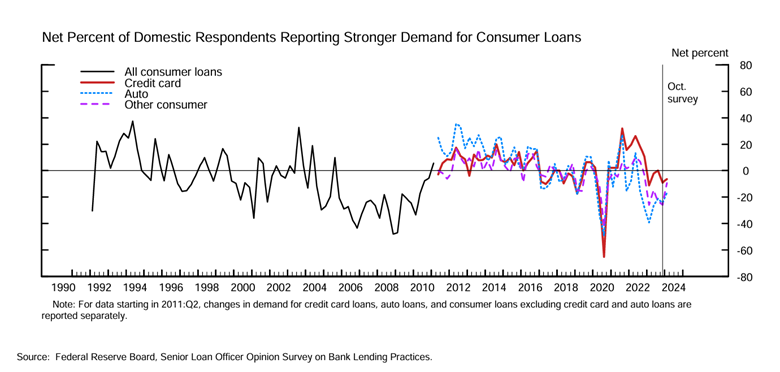

In the chart above, we have the demand trends for different types of consumer loans. Interestingly, most banks report a slight decline in demand for credit cards. This may be encouraging given the larger trend we’ve observed of ballooning credit card balances. Auto loan demand has begun to normalize. which dovetails with the recent data from Trustage that CU new auto loan is declining. The decline, now at around a -2.5% decrease in balances, is likely aggravated by tighter liquidity, manufacturer incentives, and tighter credit union underwriting. Other consumer loans were the fastest growing area of loan demand. These loans include HELOCs, implying that more households are looking to leverage home equity rather than roll credit card balances.

Future Expectations

The survey also included a set of special questions about expectations for the upcoming years. Most banks expect loan demand to increase over 2024, fueled by the ongoing economic growth and the prospect of potential rate cuts. Banks also expect to see an inflow of customers from other banks or nonbanks (such as credit unions), and, given the more optimistic views of the future economy, they expect fewer consumers will have demand for precautionary liquidity. Banks also report an expectation that they will continue tightening underwriting on consumer loans throughout 2024 as they expect to face deterioration of collateral values and the credit quality of loans already on the books, as well as lower risk tolerance, relatively higher funding costs, and potential impacts from regulatory changes. Some of this ought to sound familiar!

Credit Union Impact

So how do we put this info together? As liquidity starts to improve, many credit unions are likely considering increasing lending volumes by loosening underwriting or reducing lending rates. However, it may be difficult to do so as more banks also start to loosen their underwriting. While it may be tempting to try to compete on pricing, we anticipate that delinquencies will continue to worsen, particularly among lower credit grade borrowers. Funding costs may start to ease as interest rates decline in 2024, but with relatively tight liquidity conditions, we expect that dollars to fund new assets will remain precious. We strongly recommend consideration of the full potential profit margin of any lending strategy, and when in doubt, maybe be just a bit slower to cut those loan rates than your neighbor.