NII is a measurement that ALM modeling uses to assess your interest rate risk. Net Interest Income (NII) is a bit easier to understand than its counterpart, NEV, because the timescale is finite.

Net Interest Income is a scenario projection for earnings generated over a specified period of time. Typically, that timeframe is 12 months, but some longer scenarios, such as 24 or 36 months, are often considered.

The simulation is typically a forward projection based on a static balance sheet. This means that balance sheet items that are due to mature are replaced with an item of the same type and term based on an established assumption. It’s important to remember that this is not a forecast for future income, because the balance sheet will likely never to be truly static. Rather, the intention is to measure the degree of sensitivity that future earnings have to changes in interest rates.

Let’s look at an example:

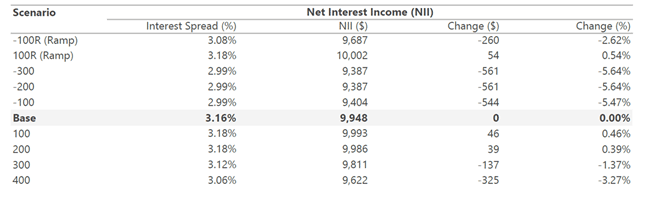

In this scenario, the base case interest income is $9,948,000. This represents an interest spread (or net interest margin) of 3.16%. All other scenarios illustrated here show the potential impact of rate changes to interest income.

In this example, the credit union is projected to generate $137,000 less of interest income if rates shocked up 3%, a reduction of a little over 1%.

Net Interest Income sensitivity is critical to understanding the short-term impacts of a rate move, but it does not explain the long-term implications. Typically, when we see a dramatic rate move as modeled in the ALM reports, that interest rate environment persists for several years. Rather, NII sensitivity shows the number of balance sheet items that are set to reprice in the timeline of the scenario. That information is critical to understanding what strategic options are available when looking to change balance sheet composition for a different economic outlook.