Accolade has compiled some data around auto lending trends that may help provide context for setting asset allocation in 2023. While many of the data trends we’re seeing are troubling for auto lenders, we are likely still in the normalization phase from the incredibly low levels of credit issues that we saw through the pandemic period.

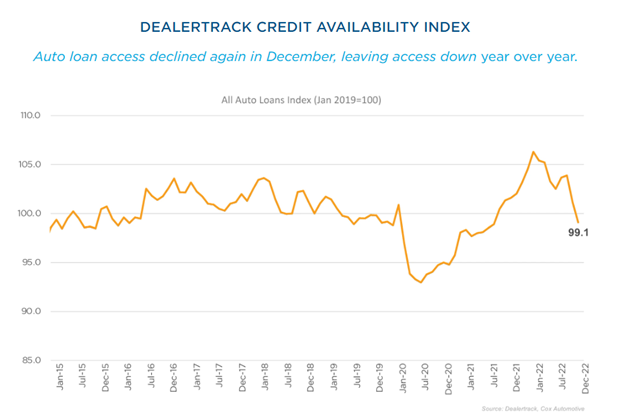

Consumer Access Declines

The Dealertrack Credit Availability Index is compiled by the parent company of Kelley Blue Book, Cox Automotive. It leverages loan application data to track shifts in loan approval rates, subprime share, yield spreads, loan terms, negative equity, and down payment size. In December 2022, the index indicated that consumer access to auto loan credit declined, and all factors were worse for borrowers, continuing a downward trend from the index peak at the start of the year. For example, the average auto loan rate increased by 8 bps while the 5-year Treasury declined by 27 bps. Average terms shortened and average down payment size also increased. The only bright spot for borrowers was a modest increased in application approval rates.

Lending Standards

The Index further breaks down these trends by lending institution on a year-over-year basis. Credit unions have tightened auto lending standards by a greater extent than banks and captive finance companies, showing a decline of around 7% vs 2.5% at banks. It appears that auto-focused finance companies are looking to fill the gap left by traditional financial institutions, as they are the only source that actually loosened underwriting this past year. This prompts speculation of how many of these companies will end up in similar circumstances to the mortgage-focused finance companies now that the housing market has slowed significantly. The overall trend is encouraging for credit unions as, at least on a relative basis, the data demonstrates that we are taking appropriate steps to prepare for future credit issues.

Price and Inventory

Used auto list prices continue to decline, now down approximately 4% from the end of 2021. We would expect to see used autos in particular to continue to depreciate at above-average rates as more new autos become available as auto producers continue to sort out supply chain challenges. Falling auto values sets up a precarious position for both borrowers and lenders, as it increases the likelihood of holding a negative equity position.

Used and new auto inventories both follow a consistent trend of lower priced cars having tighter inventories. For example, while the overall inventory of used autos is around 54 days, cars listed at less than $15,000 hold fewer than 45 days supply, whereas those above $25k have great than 60 days. We can see demand for these auto types demonstrate some of the early impacts of tighter US household budgets, where lower-cost and more efficient vehicles are holding their value to a greater extent.

Delinquencies

The overall delinquency rate for auto loans in the industry increased from 1.74% in November to 1.84% in December, now at the highest level since February 2009. That’s an increase of 39 basis points year-over-year. Drilling down further, we can see that subprime severe delinquency (60-90 days or more) increased from 6.75% to 7.11%, the highest level since 2006 and a 163 basis point increase year-over-year. We suspect that this is part of a larger trend that subprime borrowers are increasingly becoming strained by the impacts of inflation and a slowing economy. So far, these delinquencies have not translated to an increase in loan defaults. The current average default rate of 2.56% sits right between the “normal” levels seen in 2019 and the below-normal levels in 2022.

Credit Unions and Auto Lending

One final data point, the overall market share of auto loans for credit unions is now over 30%, the highest ever on record. Consumers cite better loan rates and customer experience as reasons for choosing credit union financing, and we are also seeing many dealers look to diversify their finance partners.

We applaud all credit unions for the gains in market share, but we encourage you to consider how you are funding your auto loans. If liquidity is low, you’ll need to think about the marginal cost to fund via wholesale funding rather than your average cost of funds. Liability management is an area that many credit unions will need to brush up on after a few years of seemingly endless cheap funding. Accolade’s balance sheet advisers can help you navigate today’s balance sheet challenges with holistic financial advice and reporting tools.

Investment advisory services offered through Accolade Investment Advisory, LLC, a registered investment adviser.

The views expressed are those of the authors and may not represent the view of Accolade Investment Advisory, LLC. This material represents and assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or guaranteed future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance is not a guarantee of future results. This presentation is intended for institutional investors and not intended for use by retail investors.